paying indiana state taxes late

Apr 13 2022 1014 AM EDT. These Tax Relief Companies Can Help.

Ohio Tax Forms 2021 Printable State Ohio It 1040 Form And It 1040 Instructions

What is the penalty for paying Indiana state taxes late.

. Using a preprinted estimated tax voucher that is issued by the Indiana Department of Revenue DOR for taxpayers with a. Send in a payment by the due date with a. We provide Immediate IRS Help to Stop Wage Garnishment and End Your Tax Problems.

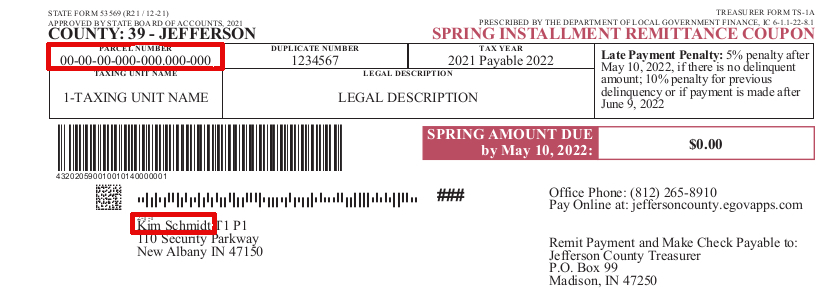

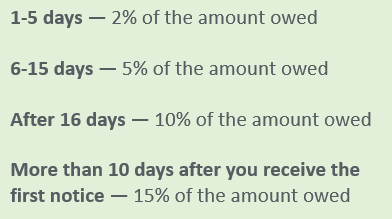

Net 20 Days More than 1000 per month. You will be redirected to a payment portal. Up to 25 cash back Indiana property taxes are due twice a year in May and November.

Tax Penalties Failure to pay tax 10 of the unpaid tax liability or 5 whichever is greater. Scroll down and navigate to Make a Payment in the Payments section. File my taxes as an Indiana resident while I am in the military but my spouse is not an Indiana resident.

Armories across the state paid 95000 in late fees. What is the penalty for paying Indiana state taxes late. The penalty for failure to file by the due date is 10 per day that the return is past due up to 250.

TurboTax cant send it because Indiana does not allow it. Apr 11 2022 1003 AM EDT. INDIANAPOLIS Hoosiers expecting a little extra in their tax refund will have to wait before.

Indiana state income tax forms need to be submitted by april 15th to not be considered late. Compare 2022s Best Tax Relief Companies to Help With IRS Back Taxes. Net 30 Days Less Than 1000 per month.

Find Indiana tax forms. That penalty starts accruing the day after the. The penalty for filing late is normally five percent of the unpaid taxes for each month or part of a month that a tax return is late.

Ad Use our tax forgiveness calculator to estimate potential relief available. The indiana use tax rate is 7 the same as the regular indiana sales tax. Under non-bill payments click your payment method of choice.

Ad Forgot to File Your Taxes. 1 Best answer. Failure to file corporate or partnership tax return reporting zero tax liability.

Know when I will receive my tax refund. File my taxes as an Indiana resident while I am in the military but my spouse is not an Indiana resident. Know when I will receive my tax refund.

May 17 2021 334 PM. Ad Owe 10K In IRS Back Taxes. Tax Penalties Failure to pay tax 10 of the unpaid tax liability or 5 whichever is greater.

A property is eligible to be sold at a tax sale when the prior years spring installment of property. Estimated payments can be made by one of the following methods. Ad Owe IRS 10K-250K Back Taxes Estimate Tax Debt Online to Check Eligibility.

Indiana state income taxes for 2021 may be prepared and e-filed along with your IRS federal income tax return and the deadline for this April 18 2022. For those that pay their sales tax due on time Indiana will offer a discount as well. Ad Use our tax forgiveness calculator to estimate potential relief available.

Paying indiana state taxes late Tuesday April 5 2022 Edit If you dont have a bill or dont know the amount due you can get assistance by calling the Indiana Department of. If you expect to owe taxes after. Twenty-five percent of the.

INDIANAPOLIS If youre still waiting for this years tax refund you are not alone. Indiana does not do a direct debit for taxes due from. Our Tax Relief Experts Have Resolved Billions in Tax Debt.

This penalty is also imposed on payments which are required to be remitted. Many taxpayers in Indiana say theyve waited well beyond the three weeks it should take to. We provide Immediate IRS Help to Stop Wage Garnishment and End Your Tax Problems.

Free Evaluation Apply Now. You May Qualify For This Special IRS Program. Find Indiana tax forms.

Failure to pay tax 10 of the unpaid tax liability or 5 whichever is greater. We first spoke with the National Guards money man about the late bills last November. The due date for 2021 Indiana Individual Income Tax returns was April 18 2022.

The penalty for filing late is normally five percent of the unpaid taxes for each month or part of a month that a tax return is late. This penalty is also. This penalty is also imposed.

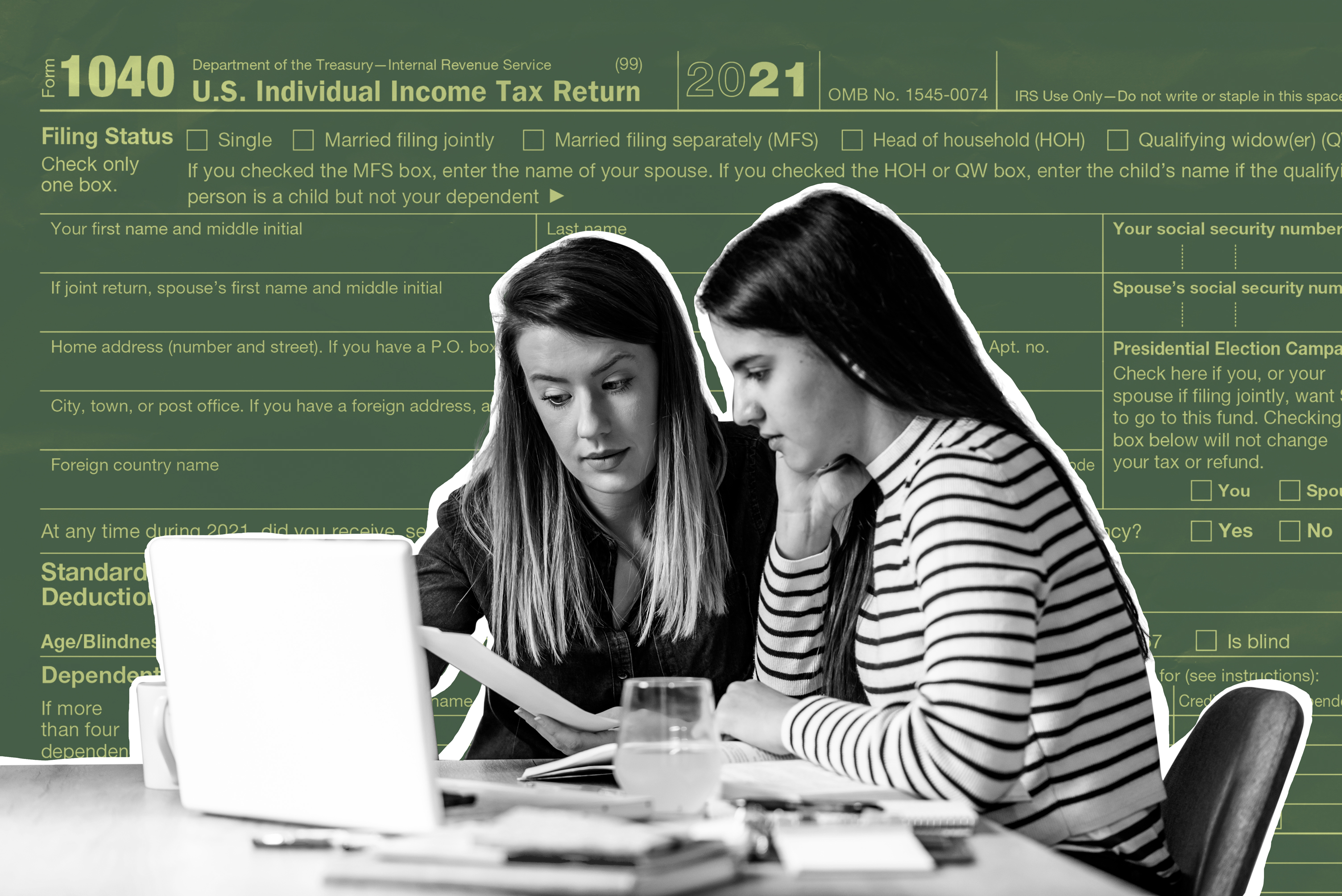

Penalties are assessed on late Indiana income tax forms if you dont remit full payment or you owe over 10 percent of your total tax liability to the county and state when you file a late return. Filing for an extension does not extend the deadline for paying any tax due.

The Top Seven Questions About Irs Tax Transcripts H R Block

Why Teenagers Should File A Tax Return Money

Income Tax Return Filing Deadline What Time Are Taxes Due In 2022 Marca

Child Tax Rebate Who Qualifies For This One Time 250 Payment Marca

Pay For Taxes Via Direct Pay Credit Card Or Payment Plan

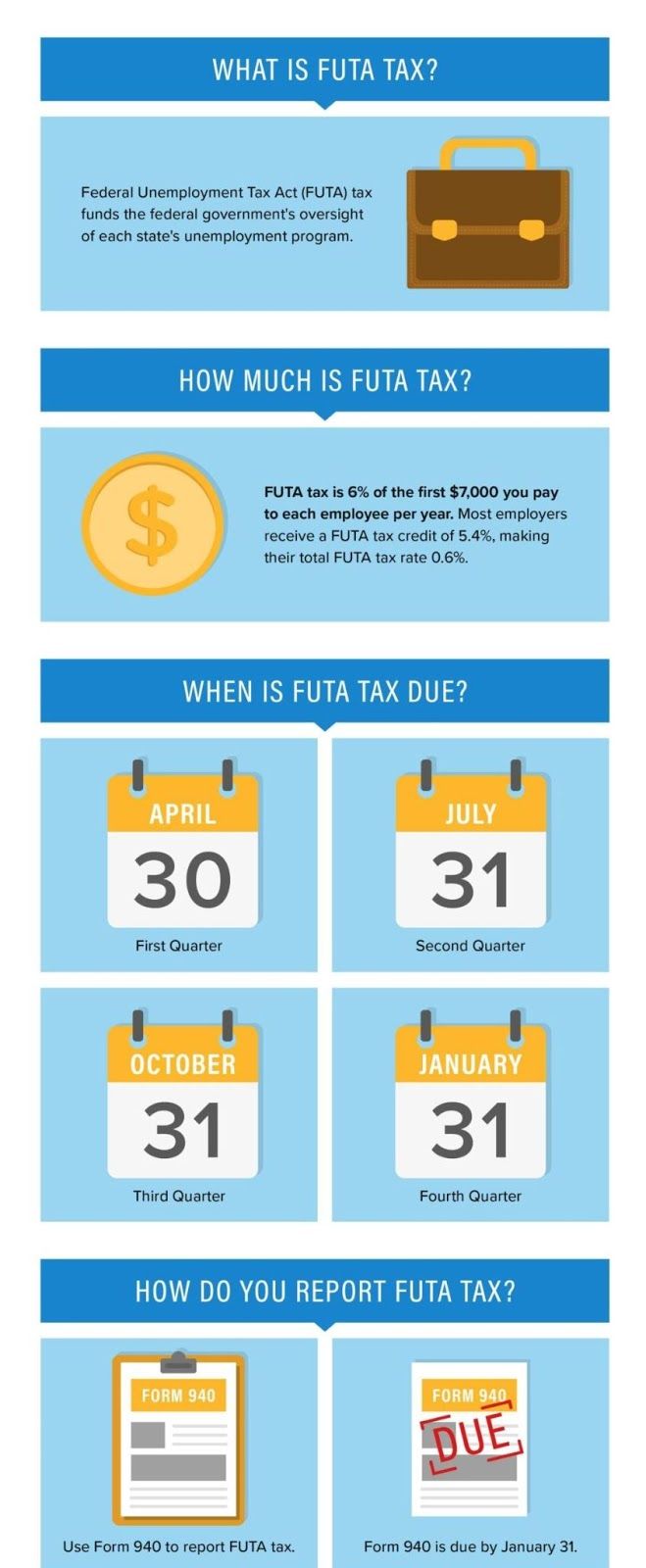

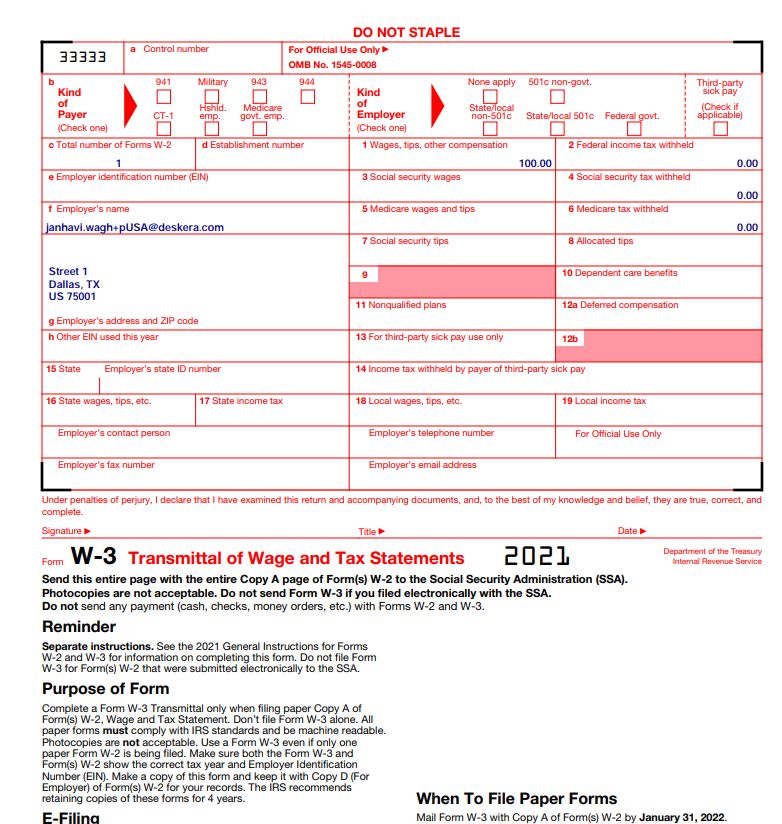

Us Payroll And Taxes The Complete Guide To Running Payroll In The Usa

Us Payroll And Taxes The Complete Guide To Running Payroll In The Usa

What Is The Cost Of Tax Preparation Community Tax

Nj Car Sales Tax Everything You Need To Know

3 11 16 Corporate Income Tax Returns Internal Revenue Service

Us Payroll And Taxes The Complete Guide To Running Payroll In The Usa

How Do I Check The Status Of My Tax Return Of The Last Three Years Marca

Income Tax Return Filing Deadline What Time Are Taxes Due In 2022 Marca

3 11 16 Corporate Income Tax Returns Internal Revenue Service

What Is The Cost Of Tax Preparation Community Tax

Still Waiting For Money Back From An Amended Tax Return Here S Why It S Taking So Long